Note: These assumptions are now outdated. Our current capital market assumptions and our white paper documenting their construction can always be found on our Capital Market Assumptions page.

Sellwood Consulting’s 2016 Capital Market Assumptions are available. These 10-year forward looking assumptions of asset class return, risk, and correlation are the key input variables for our client asset allocation work, including mean-variance optimization, Monte Carlo analysis, and risk budgeting.

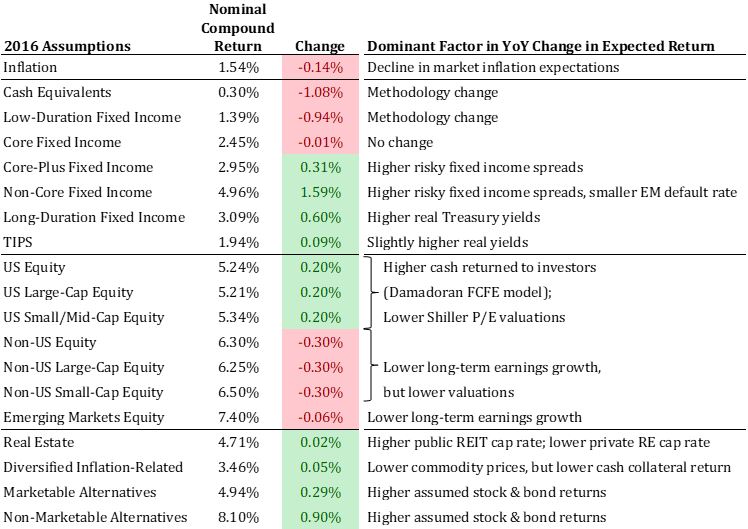

We update our assumptions annually. Over the course of 2015, we saw Treasury yields rise, and yield spreads for higher-risk fixed income rise as well. These two factors caused an upward adjustment to our return assumptions for fixed income securities, generally speaking. For US equities, a flat market in the face of higher cash returned to investors in 2015 provided for lower valuations, resulting in slightly higher return projections. Internationally, lower valuations were overwhelmed by a decline in earnings and their long-term growth rates, resulting in lower forecasted return.

The following chart depicts Sellwood’s 2016 compound return assumptions, relative to those we created for 2015:

A change in methodology for calculating a proxy for market-expected inflation meaningfully changed our return projections for cash equivalents and low-duration fixed income. For all asset classes, we have replaced CPI with Core CPI for calculations of expected inflation in periods prior to 2003, before a TIPS breakeven spread was published. We found that core CPI has been a better predictor of future inflation than has CPI. As with all fixed income asset categories, our forecasts imply a partial reversion to a long-term average real yield, and our updated methodology changed that long-term average. Due to their sensitivity to inflation, cash equivalents and low-duration fixed income were affected most by this methodology improvement.

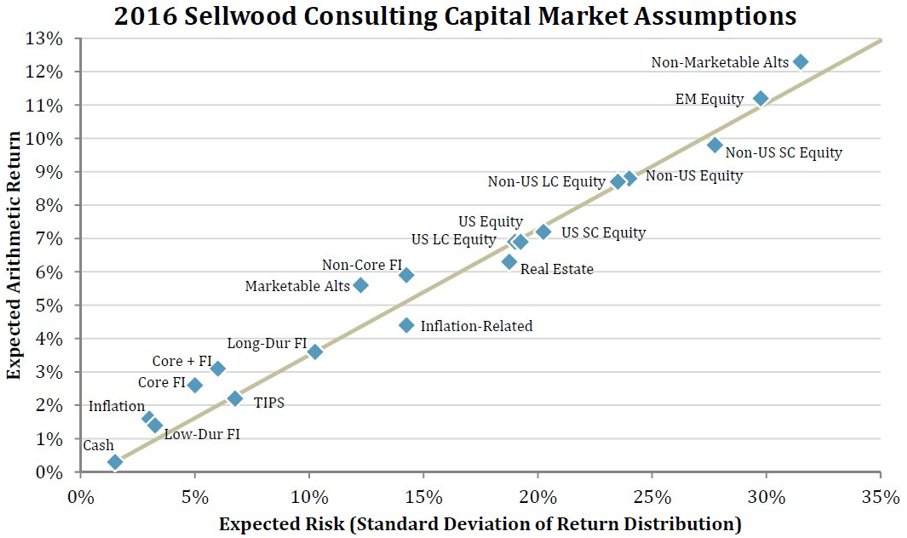

Our assumptions continue to imply a prospective low-return environment for financial assets relative to historical averages. Further evidence of this environment has recently been highlighted by several credible industry researchers. Our assumptions are consistent with this analysis. Please also see our post, Realism in Forecasting, which explains our comfort with having forecasts outside the range of many of our peers.

Though we have made incremental enhancements to our methods for gauging the future value of assets, we have maintained our focus on the primary, reliable drivers of risk and return. Our assumptions are anchored in the empirical facts presented by long-term capital markets rather than speculative observations on recent market conditions. We avoid unnecessary complexity, preferring instead to rely upon transparent strategies that work reliably. Our analysis is comprehensive, but not complicated, because we are convinced that the most robust solutions have no hidden constraints and few moving parts. These same principles – pragmatic research and simplicity in execution – guide all of our work for clients.

Presented in annual arithmetic average terms, our 2016 assumptions are depicted in the following chart:

Sellwood Consulting updates its capital markets assumptions on an annual basis. Our 2016 assumptions reflect information as of December 31, 2015, unless otherwise noted. Our assumptions are forward-looking in nature and reflect a ten-year investment horizon.

We have comprehensively documented our methodology and process for creating these capital markets assumptions in our updated 2016 Capital Market Assumptions white paper.