Note: These assumptions are now outdated. Our current capital market assumptions and our white paper documenting their construction can always be found on our Capital Market Assumptions page.

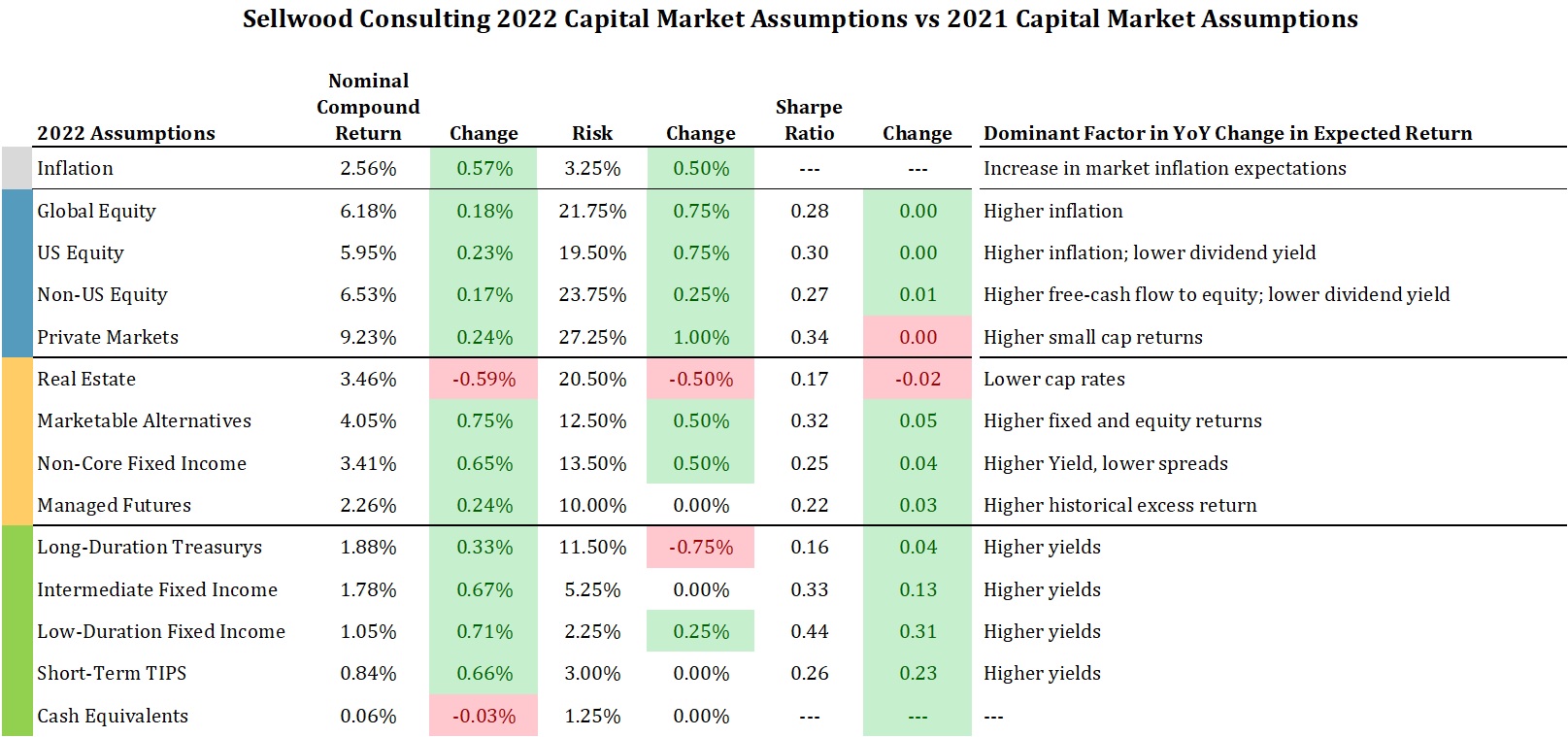

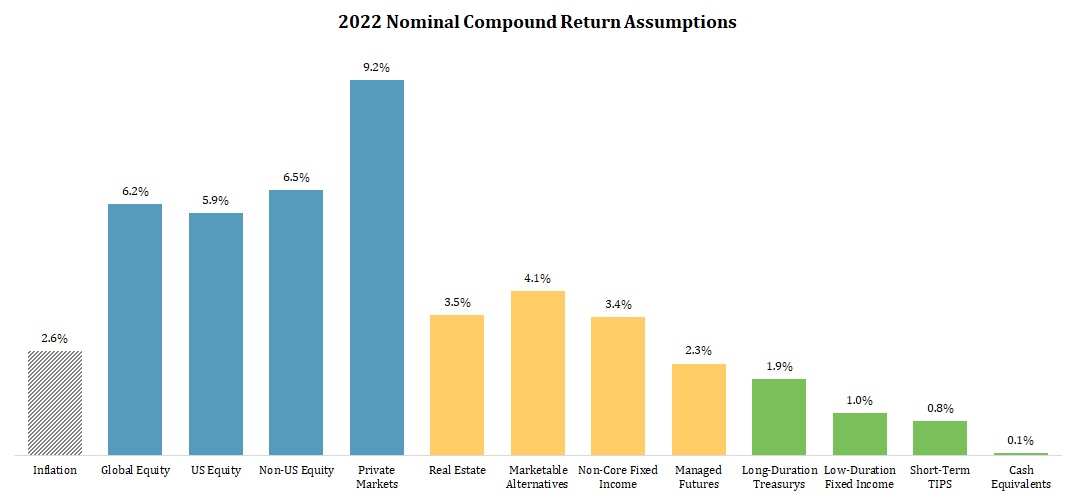

Sellwood’s 2022 Capital Market Assumptions portray a more optimistic environment for most asset classes, compared to a year ago.

Investor expectations for inflation are a core building block for both market prices and their prospects for future return. Rising inflation expectations contributed to an increase in our return expectations for most asset classes. Importantly, our assumptions are nominal in nature, so our higher forecasted returns do not necessarily imply higher purchasing power in the future.

Rising inflation expectations pulled fixed income yields higher over the course of 2021. Across the full Treasury yield curve, nominal interest rates for default-free Treasury assets rose by an average of 0.53%. Yields for bonds with modest credit risk rose by a bit more than that as spreads widened. Our forecasts for fixed income return have risen by approximately 0.30%-0.70%, consistent with the slightly higher expected returns offered by markets at the beginning of this year, compared to a year prior.

Equities are more challenging to forecast, and therefore have a wider assumed distribution of outcomes. Our forecasts for stock markets also rose, but by a smaller amount – approximately 0.15%-0.25% per year. This modest increase reflects our expectation that companies benefit, in nominal terms, from higher inflation. Our US equity assumption rose by a bit more than our non-US equity assumption did, partially reflecting that 2021’s performance for the US stock market, while extraordinary, underperformed corporate earnings performance, which was even more extraordinary.

Diversifiers mostly saw increased returns as well, reflecting their partial sensitivity to stock and bond markets. The only exception is real estate: very high recent returns have collapsed REIT yields (cap rates) to historic lows, reducing their expected return.