Note: These assumptions are now outdated. Our current capital market assumptions and our white paper documenting their construction can always be found on our Capital Market Assumptions page.

Sellwood’s 2023 Capital Market Assumptions represent our best current thinking about future returns. They are the essential building blocks of the asset allocation work we perform for clients.

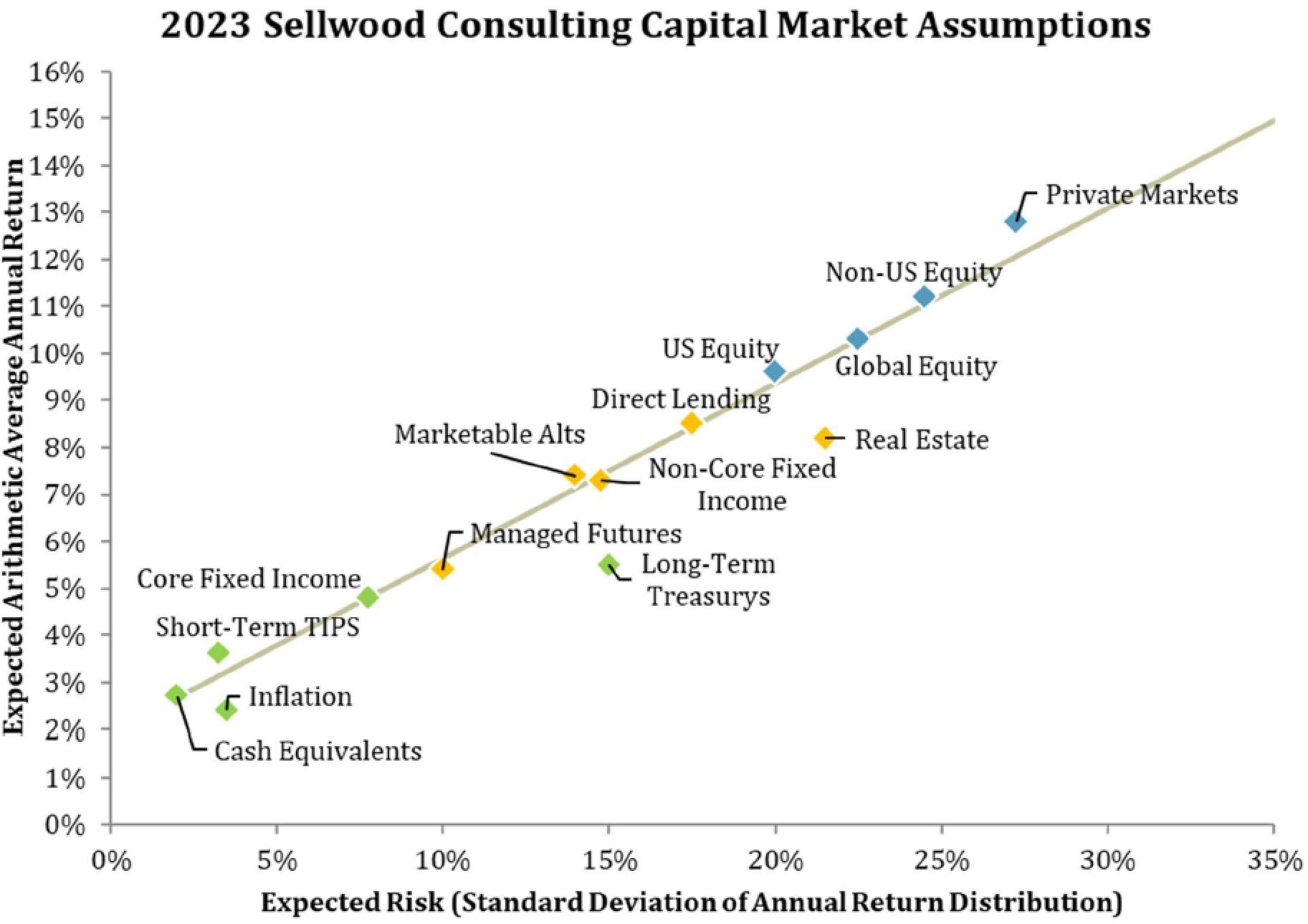

Each year, though make incremental enhancements to our methods for gauging the future value of assets, we maintain our focus on the primary, reliable drivers of risk and return. Our assumptions are anchored in the empirical facts presented by long-term capital markets rather than speculative observations on recent market conditions. We avoid unnecessary complexity, preferring instead to rely upon transparent strategies that work reliably. Our analysis is comprehensive, but not complicated — because we are convinced that the most robust solutions have no hidden constraints and few moving parts.

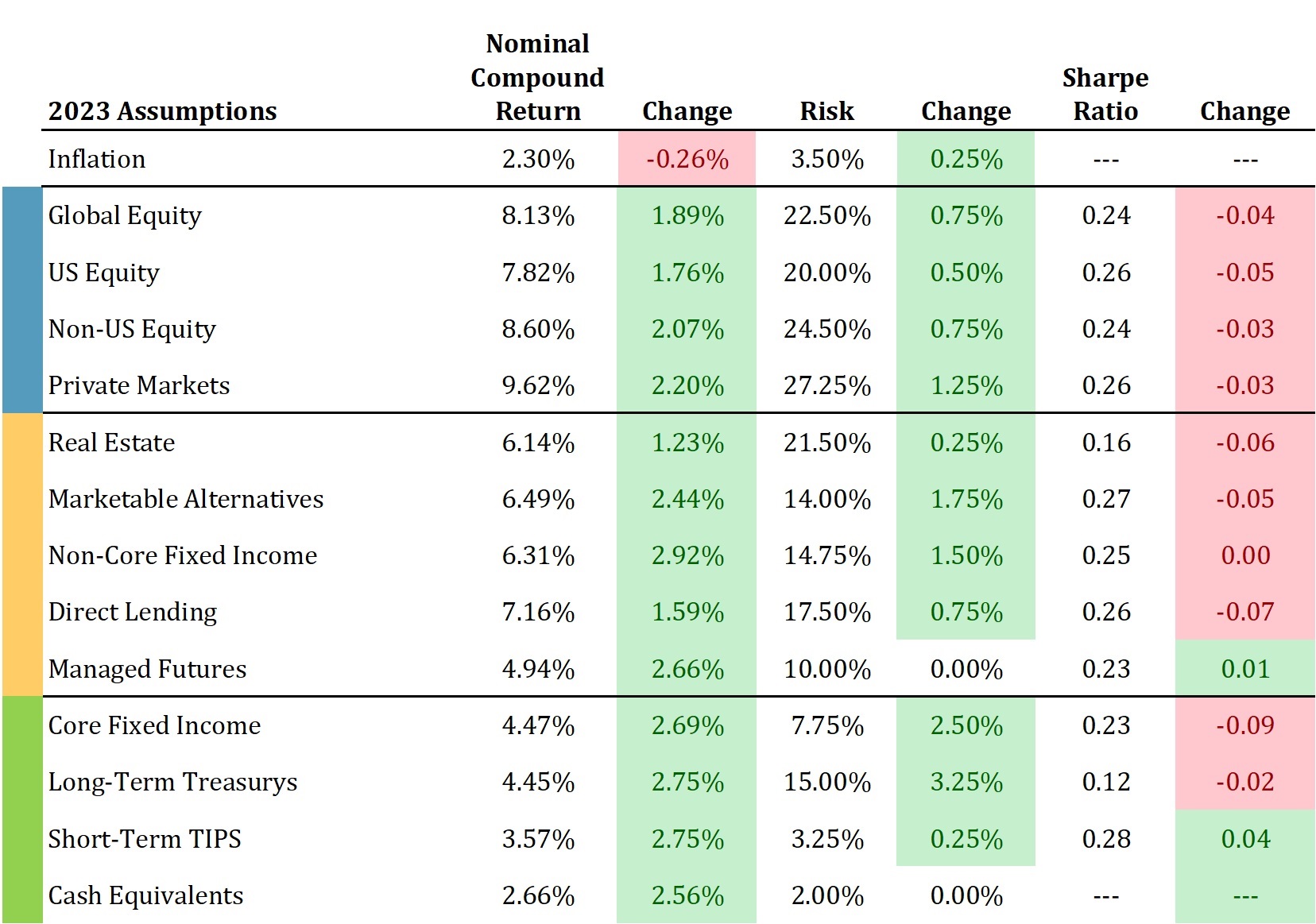

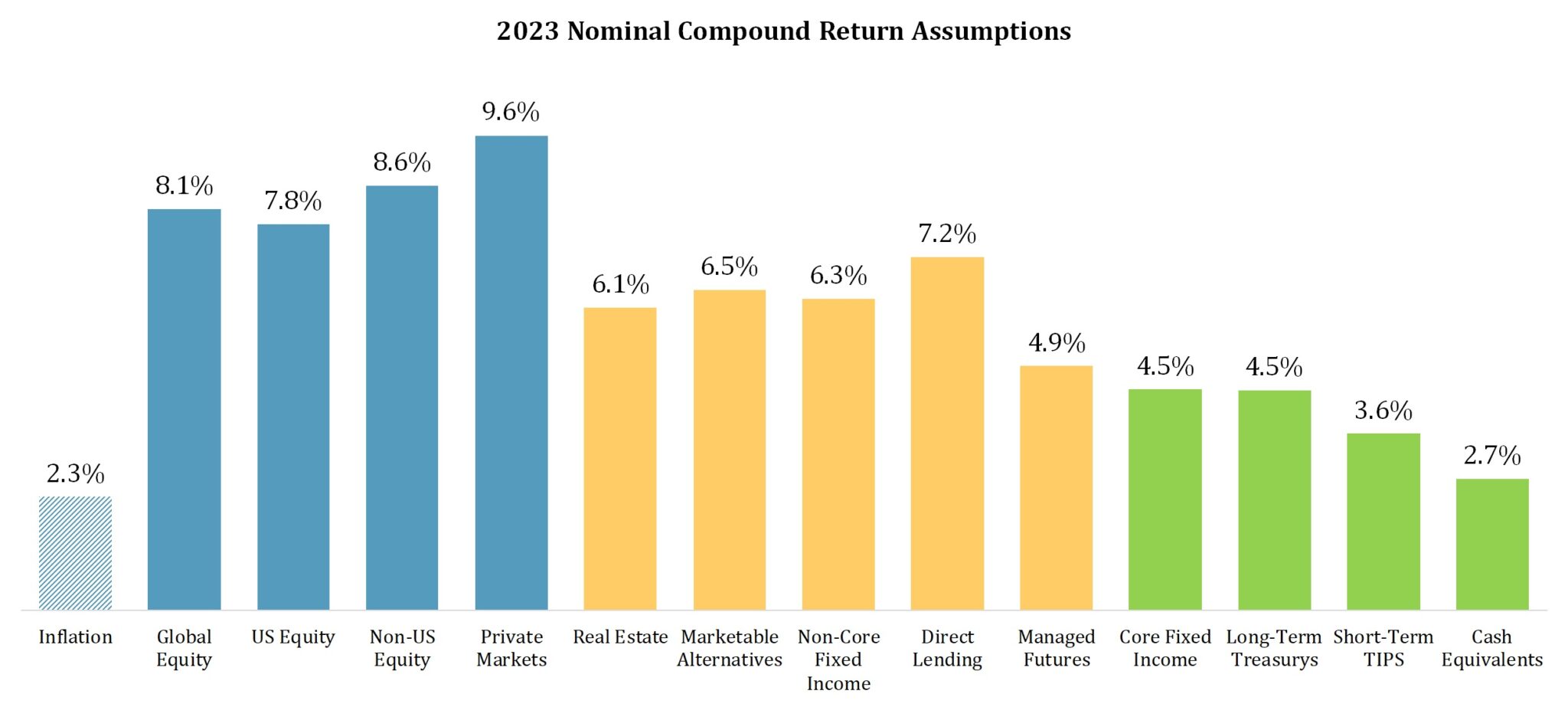

We update the assumptions annually, and this year’s update to the assumptions saw increases in both expected return and risk, across every major asset class we evaluate. The reasons for higher expected return are simple: higher yields imply higher expected returns from bonds, and lower equity valuations imply higher returns from stocks. Diversifiers, sharing characteristics of both stocks and bonds, rose in tandem.

The higher expected risk for most asset classes is less intuitive. To model “risk,” we are calculating the expected standard deviation of returns, which is a statistical explanation of the shape of a normal distribution of return outcomes. Input assumptions for traditional asset allocation modeling use normal distributions, but the world is not normal — so our task in creating risk assumptions is to shoehorn a non-normal world into a normal distribution, which creates tradeoffs to consider.

Our risk assumptions rely both on the historically observed distribution of returns, but also the historically experienced worst case scenario (2008, for most risky asset classes, and 2022, for fixed income), which in some cases is outside the “normal” distribution drawn by all the other observations. In those cases, we widen the distribution of outcomes enough, by increasing the expected “risk,” so that the actual historical worst case is inside the distribution. As the lower valuations and higher yields of 2022 pushed our assumed returns higher, shifting whole return distributions upward, the distributions needed to get wider to accommodate that historical worst case.

The world isn’t any riskier today than it always is, but the outcome distributions may just be wider. This is one reason among many that we believe it is essential to develop intelligent forward-looking assumptions rather than simply relying on historical returns to develop optimal portfolios, or intuitions about future returns.

Our assumptions imply a much more interesting environment for capital allocation than existed a year ago. Consistent with our 2023 Investment Themes, our 2023 Capital Market Assumptions imply a market environment in which:

- finally, reasonable returns may be earned from high-quality bonds;

- stocks offer more historically “normal” return prospects;

- non-US equities offer more compelling return opportunities than their US counterparts; and

- correlations, especially between stocks and bonds, cannot be counted on for diversification as much as they have for the last 20 years.

Finally, we note the inflation assumption. Its decline is not a typo — our forward-looking assumption for inflation actually declined over the last year. This is simply because our 10-year expectation for inflation reflects the market’s own expectation, as implied by the difference between 10-year nominal Treasury bonds and 10-year Treasury Inflation Protected Securities (TIPS). Market-based inflation expectations peaked in early 2022 and have declined since then.