Download our 2024 Capital Market Assumptions Report.

Download our 2024 Capital Market Assumptions Report.

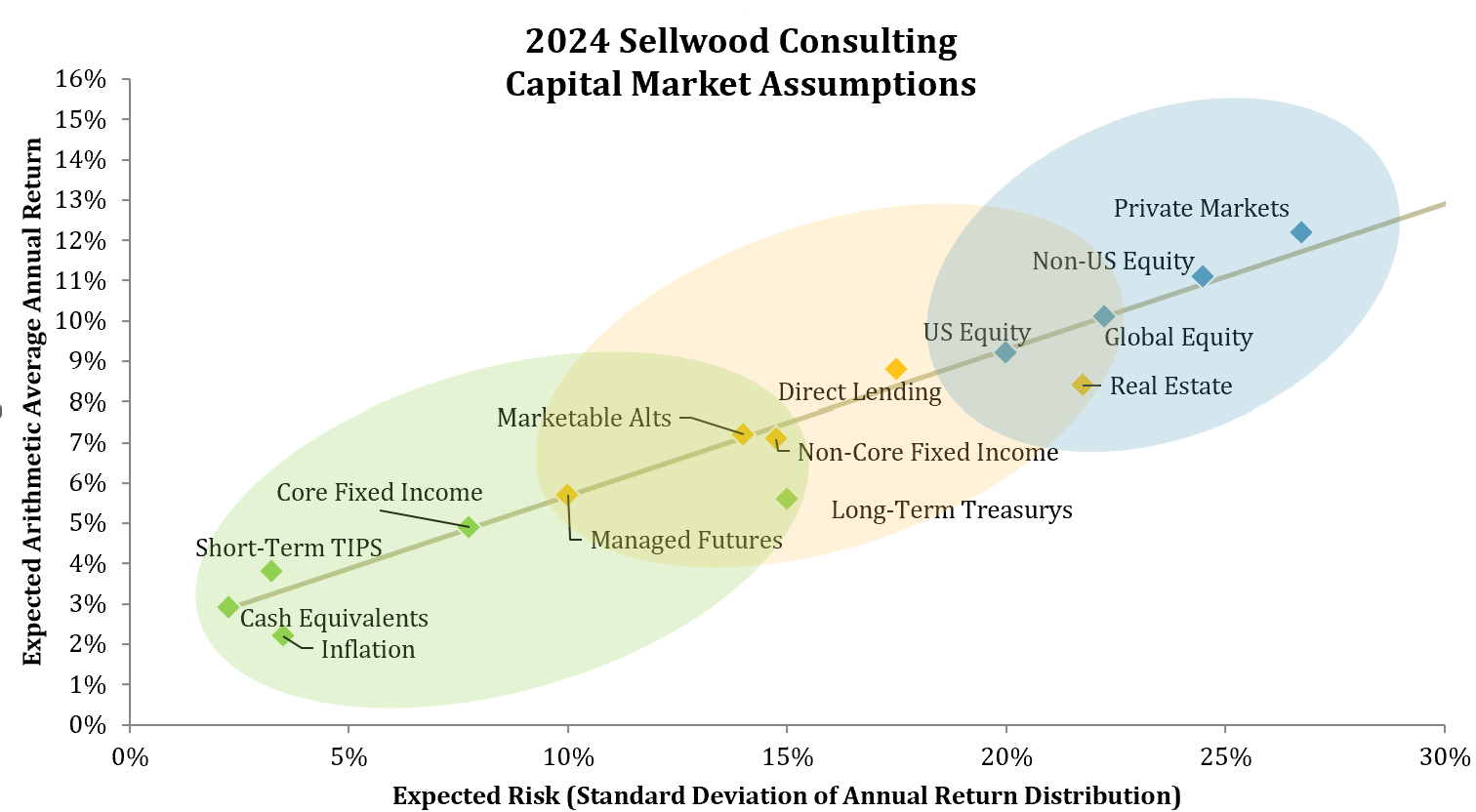

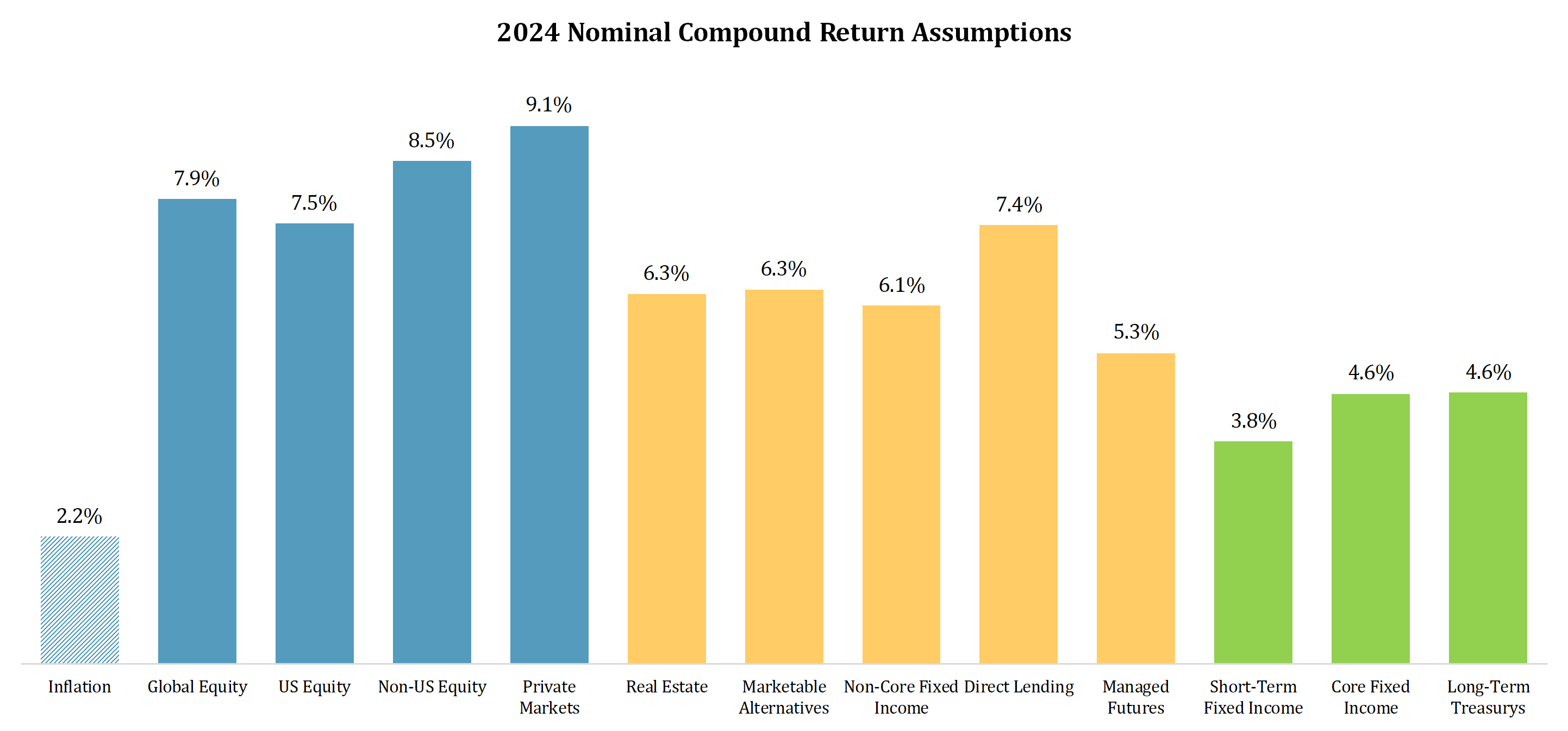

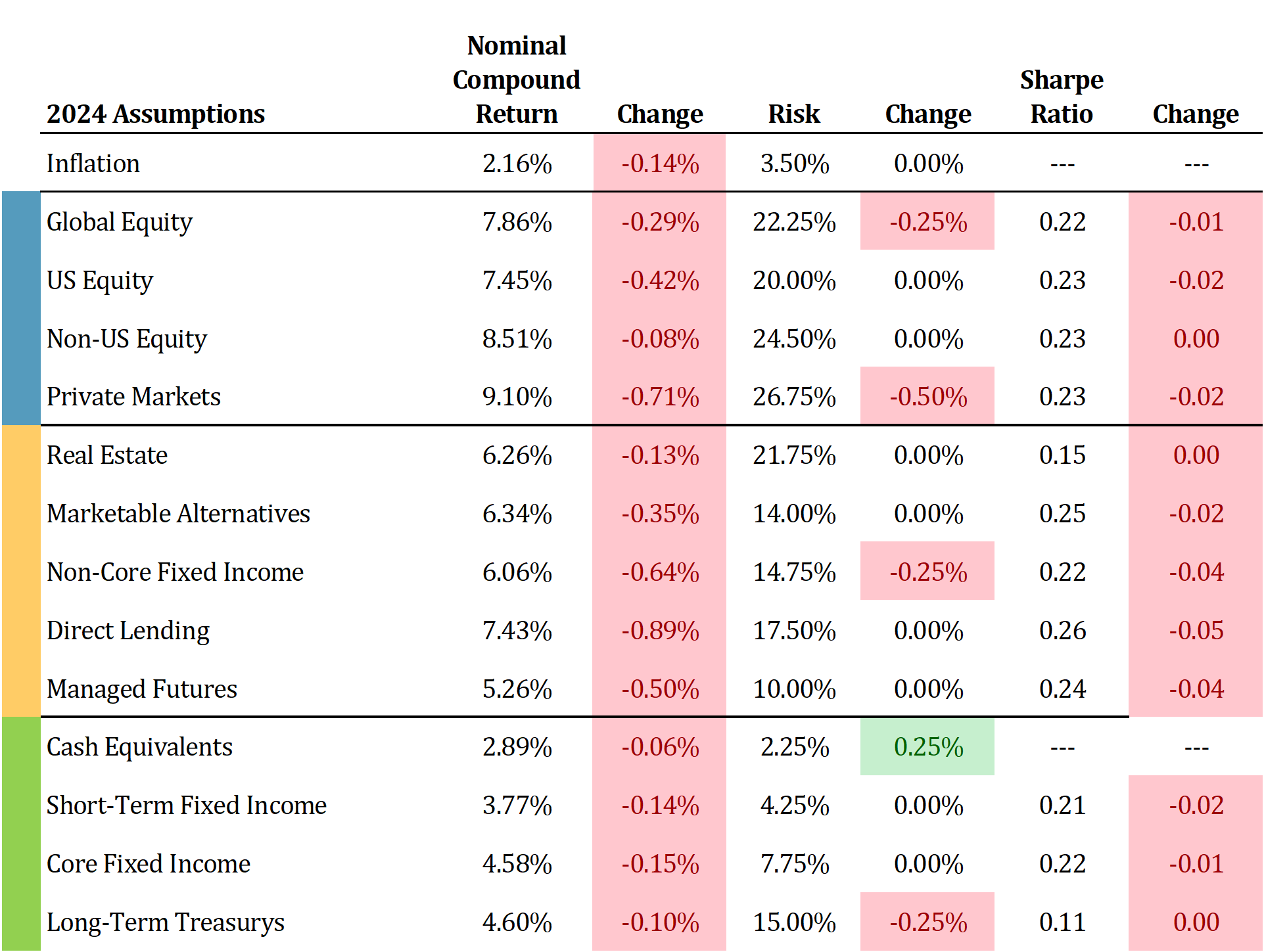

Sellwood’s 2024 Capital Market Assumptions represent our best current thinking about future returns. They are the essential building blocks of the asset allocation work we perform for clients.

Our 2024 return and risk assumptions are presented below:

We update our capital market assumptions annually. This year, we reduced our return expectations for every major asset class. The reasons for this are simple. In 2023, global stock markets had a banner year. Some of the exceptional return was earnings improvement, but some of it was multiple expansion — or an increase in the amount of dollars investors were willing to pay for the market’s dollar of earnings. This multiple expansion component borrows from future return, so we reduced future return expectations accordingly. In fixed income, marginally lower yields led to marginally lower return expectations. In the long run, returns to bond investments follow their yields, and our assumptions honor this principle.

More detail can be found in our 2024 Capital Market Assumptions paper.

Each year, though make incremental enhancements to our methods for gauging the future value of assets, we maintain our focus on the primary, reliable drivers of risk and return. Our assumptions are anchored in the empirical facts presented by long-term capital markets rather than speculative observations on recent market conditions. We avoid unnecessary complexity, preferring instead to rely upon transparent strategies that work reliably. Our analysis is comprehensive, but not complicated — because we are convinced that the most robust solutions have no hidden constraints and few moving parts.