Download our 2025 Capital Market Assumptions Report.

Download our 2025 Capital Market Assumptions Report.

Our forward-looking assumptions are the key input variables for our asset allocation work on behalf of clients.

Each year, though make incremental enhancements to our methods for gauging the future value of assets, we maintain our focus on the primary, reliable drivers of risk and return. Our assumptions are anchored in the empirical facts presented by long-term capital markets rather than speculative observations on recent market conditions. We avoid unnecessary complexity, preferring instead to rely upon transparent strategies that work reliably. Our analysis is comprehensive, but not complicated — because we are convinced that the most robust solutions have no hidden constraints and few moving parts. These same principles – pragmatic research and simplicity in execution – guide all of our work for clients.

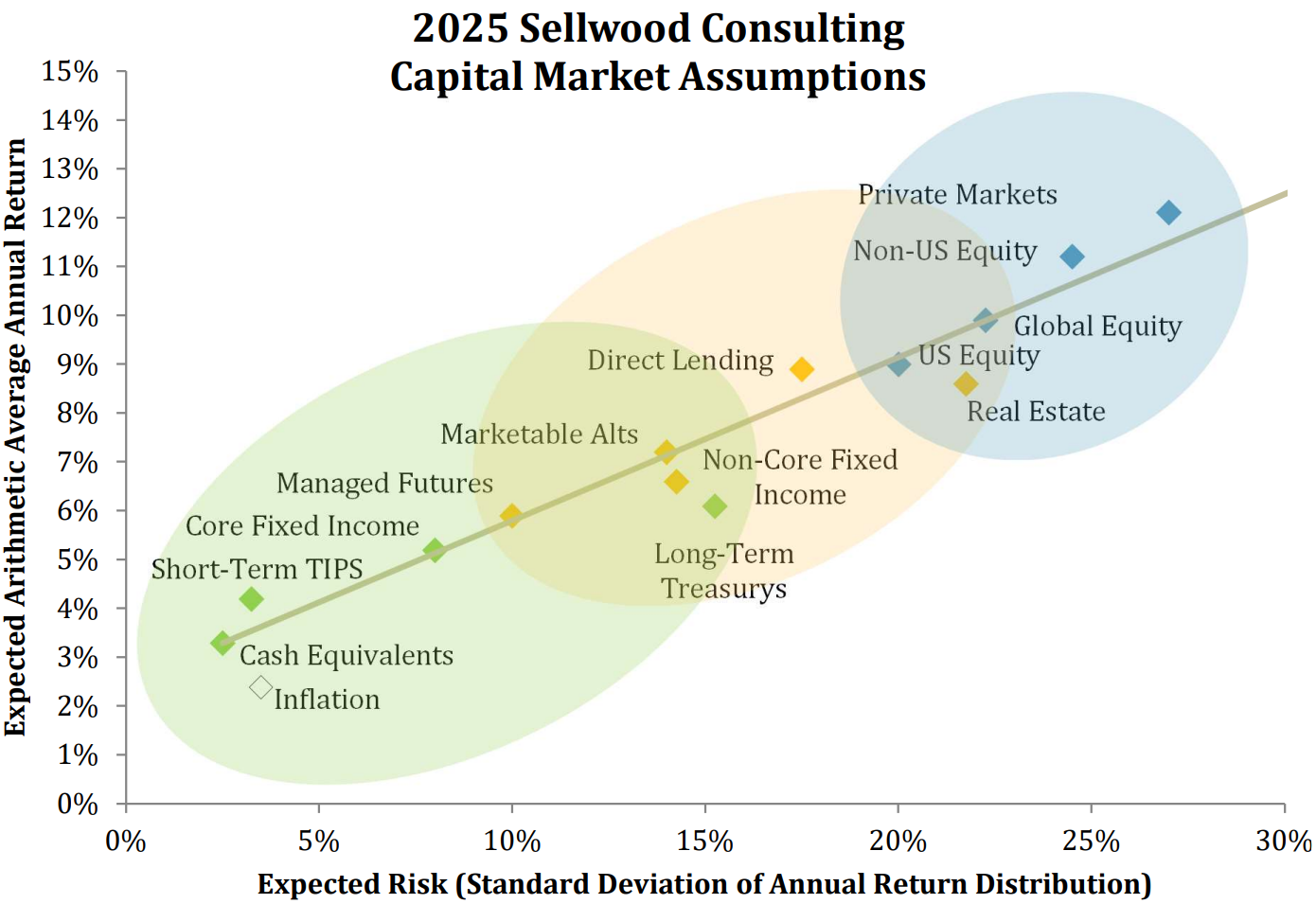

Presented in nominal annual arithmetic average terms, our current capital market assumptions are depicted in the following chart:

Sellwood Consulting updates these capital markets assumptions annually. Our assumptions are forward-looking in nature and reflect a ten-year investment horizon.

This report documents our process for creating these capital markets assumptions, and we provide detailed methodology for each. You may download a PDF of the report.

Several over-arching principles inform all of our analysis regarding forward-looking capital market assumptions:

We believe in full transparency, and in exposing our research to scrutiny. All of Sellwood’s capital market assumptions, past and present, can be found here:

Capital Market Assumptions by Sellwood Investment Partners is licensed under a Creative Commons Attribution-NoDerivatives 4.0 International License.