Every year, we update our forward-looking Capital Market Assumptions – the building blocks of our asset allocation work on behalf of Sellwood clients – as of December 31. Because equity and bond markets have changed so considerably in the first quarter of this year, we have taken the extraordinary step of updating those assumptions outside our normal calendar. With this update, our asset allocation work for clients will reflect market data as of March 31, 2020.

In the first quarter of 2020, equity values plunged, credit spreads widened, and Treasury bond yields declined substantially. The US stock market registered its fastest 30% decline in history while US corporate bonds lost 7% in March. US Treasury bonds were one of the few investments that provided a positive return as yields fell below 1% across the entire yield curve. Inflation expectations for the next ten years were roughly cut in half, as market participants began to process the likelihood of a looming recession. We believe that these dramatic first-quarter market movements have improved return prospects for public equities by about 0.5% per year over the coming decade, and reduced return prospects for investment-grade bonds by about 0.5% to 1.5% per year over the same horizon.

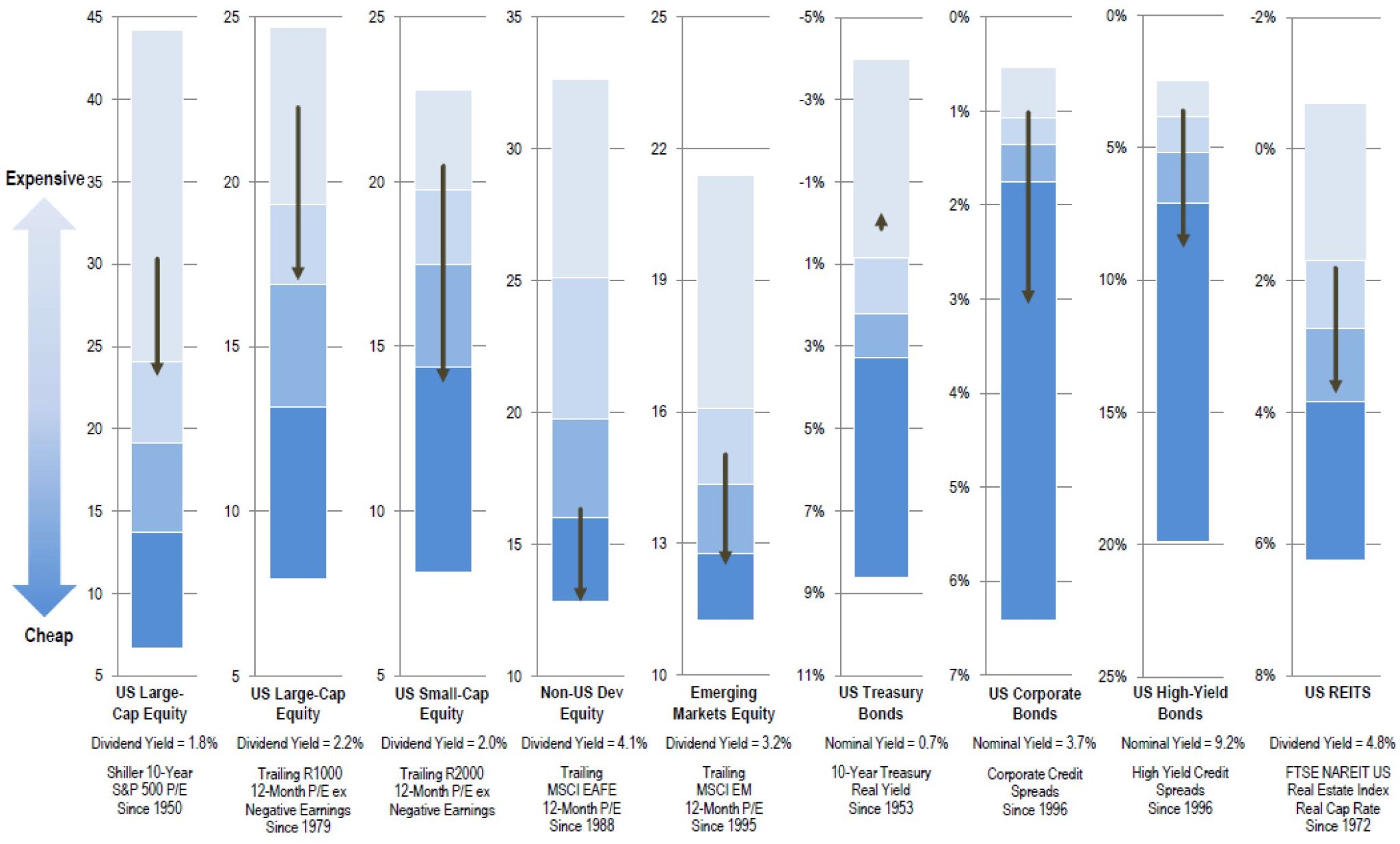

As stock and bond prices changed in the first quarter, their valuations – which inform future returns – changed as well. The following chart depicts a signature valuation metric for several major asset classes. The blue boxes represent quartiles of each valuation metric’s own history, and the arrow represents the change in that valuation metric from December 31, 2019, to March 31, 2020:

In the first quarter, equities and riskier bonds (corporate and high-yield issues) became substantially cheaper and US Treasury bonds became more expensive. As market participants grappled with an unfolding pandemic and processed its implications for the economy, investment safety became more expensive and risk-taking became more rewarding.

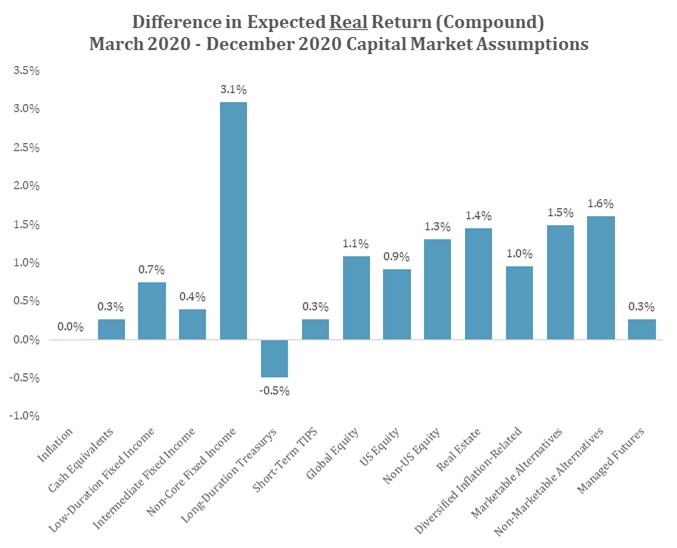

Translated into forward-looking assumptions, recent market changes reveal some interesting opportunities. The following chart depicts the real (after-inflation) changes to our annualized 10-year, forward-looking assumptions for compound return. We assume that the prospective return for long-duration Treasury bonds declined, but every other asset class improved:

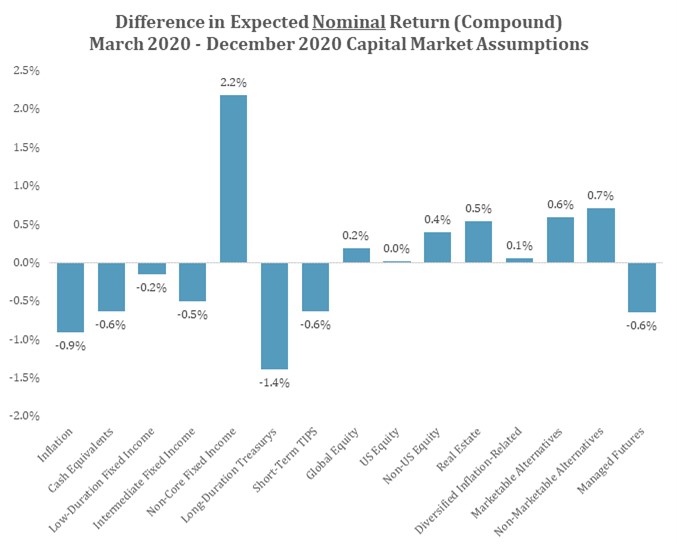

If inflation expectations did not change, the recent market decline would also have resulted in higher nominal (before-inflation) expected returns nearly every asset class. Higher recession probabilities, however, caused inflation expectations to decline along with risky assets. Our process incorporates future inflation expectations to derive the “headline” nominal compound return assumption. After taking lower inflation expectations into account, we expect that changing markets in the first quarter reduced future bond returns by between 0.6% and 1.4%, and increased equity returns by about 0.4% to 0.5%.

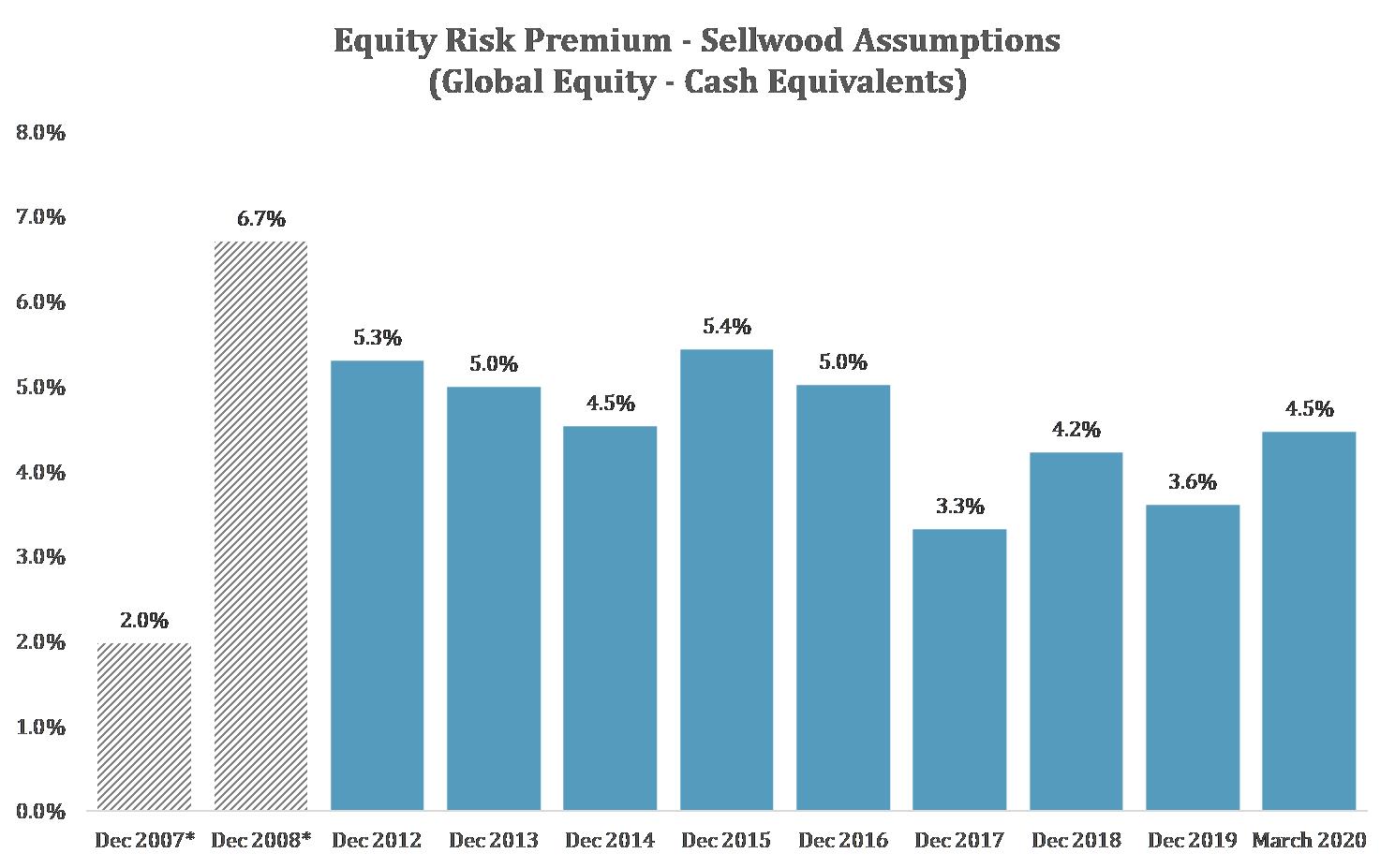

Forecasting higher equity returns, and lower cash returns, means that we are forecasting a higher equity risk premium than we did at the end of the year. The equity risk premium represents expected future compensation for taking the investment risk of owning stocks, relative to owning riskless cash. Prior to the first quarter of 2020 unfolding, we forecasted nearly the lowest equity risk premium since 2012. Stock markets were priced for nearly everything to go right. After the first quarter, when almost nothing went right, we now estimate that the premium has increased by nearly one percentage point a year for the coming decade. While falling short of representing a generational opportunity, we note that stocks are priced to deliver meaningfully better returns, relative to other opportunities, than they were just three months ago. (As a reference point, our methodology would have forecast an equity risk premium of just 2.0% in December 2007, and 6.7% in December 2008.)

In summary:

- The first quarter’s market movements were substantial enough, in our view, to meaningfully alter the prospects for investment return over the full coming decade. Accordingly, we have revisited and updated our prospective 10-year Capital Market Assumptions to reflect the new information the market has given us.

- Lower yields for US Treasury bonds reflect an unprecedented premium on safety and have reduced prospects for their future return.

- Future returns for high-quality fixed income outside of US Treasury bonds have benefited from lower valuations on a real (inflation-adjusted) basis, but lower inflation expectations result in lower nominal expected returns.

- Lower valuations for risky assets like global stocks provide support for higher future return.

- Compensation for taking investment risk has increased. Risk is positioned to be more richly rewarded over the coming decade than it was a quarter ago.

- Non-Core fixed income, which we define as below-investment-grade and emerging markets bonds, may present a meaningful, if fleeting, opportunity for return enhancement. US High-yield spreads rose sharply not only in response to the global pandemic, but also in response to an oil price war between Russia and Saudi Arabia.