Capital Market Assumptions: Mid-Year Update

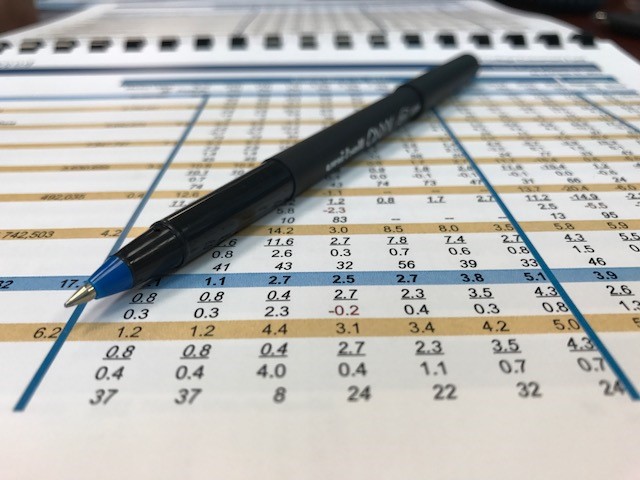

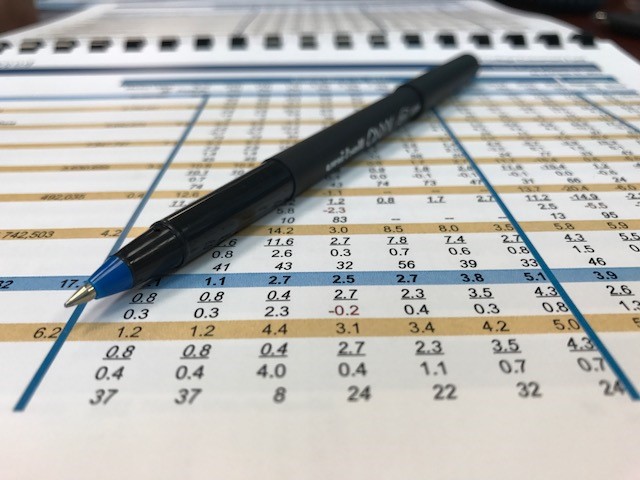

Every year, we update our forward-looking Capital Market Assumptions – the building blocks of our asset allocation work on behalf of Sellwood clients – as of December 31. Because equity and bond markets have changed so considerably in the first quarter of this year, we have taken the extraordinary step of updating those assumptions outside our normal calendar. With this update, our asset allocation work for clients will reflect market data as of March 31, 2020.

2020 Capital Market Assumptions

These assumptions are now outdated. Our current capital market assumptions and our white paper documenting their construction can always be found on our Capital Market Assumptions page.

Ten Years, Ten Observations, and Ten Predictions

This past March marked the 10-year anniversary of the market bottom that concluded the 2008/2009 Global Financial Crisis. The decade ending March 31, 2019 was a very interesting one for market observers and practitioners. We offer ten market observations from that decade, and, informed by history, ten predictions about what the next ten years may hold.

Modeling the Reality of Risk in 2019

March 2009. The S&P 500 has just fallen 55% from its peak and the trailing ten-year standard deviation of S&P 500 returns was 21%. The market trades at a valuation of 13 times trailing 10-year normalized real earnings. Or…

2019 Capital Market Assumptions

These assumptions are now outdated. Our current capital market assumptions and our white paper documenting their construction can always be found on our Capital Market Assumptions page.

Rise and Shine: Why Bond Investors Still Shouldn’t Fear Rising Rates

Back in 2014, we wrote a piece, Who’s Afraid of the Big Bad Rates?, which argued that long-term investors in fixed income securities should not fear rising rates.

2018 Capital Market Assumptions

Sellwood Consulting’s 2018 Capital Market Assumptions are available. These 10-year, forward-looking assumptions of asset class return, risk, and correlation are the key input variables for our asset allocation work on behalf of clients.

Postmortem of a Correction

Loathe as we are to give any thought to short-term returns, the recent market correction has been interesting.

“Fiduciary” Isn’t Enough

Political language is designed to make lies sound truthful and murder respectable, and to give an appearance of solidity to pure wind. One cannot change this all in a moment, but one can at least change one’s own habits

The Not-So-Lost Decade

Today marks the 10th anniversary of the birth, or at least the conception, of the Global Financial Crisis. The US equity market peaked, before the Global Financial Crisis began, on October 9, 2007.