The Right and Wrong Way to Design a Portfolio

Our research department believes that the President’s agenda will stall in Congress, the Fed is on pace for two more rate hikes this year, and that we are seeing really promising economic growth out of Asia. As a result, we recommend that you shift a bit of money out of core bonds and into international equities for the next six months.

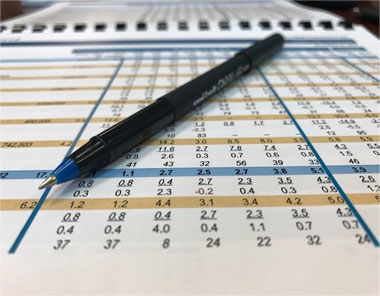

2017 Capital Market Assumptions

Sellwood Consulting’s 2017 Capital Market Assumptions are available. These 10-year forward looking assumptions of asset class return, risk, and correlation are the key input variables for our client asset allocation work.

It’s No Secret: The Importance of a Defined Investment Philosophy

We would like to share with you our secret formula for delivering superior investment advice. Few other investment advisory firms share it, and most clients overlook its importance. This secret formula allows us to recommend better managers, avoid the common mistakes we see our peers making, and deliver client portfolios that regularly outperform their benchmarks and peers.

2016 Capital Market Assumptions

Sellwood Consulting’s 2016 Capital Market Assumptions are available. These 10-year forward looking assumptions of asset class return, risk, and correlation are the key input variables for our client asset allocation work, including mean-variance optimization, Monte Carlo analysis, and risk budgeting.

Common-Sense Investment Manager Research

There are too many investment managers in the world, and one of our primary tasks is identifying the very slim minority of them that deserve to manage our clients’ assets.

In 1991, William Sharpe published The Arithmetic of Active Management, in which he persuasively concluded, because all markets are a zero-sum game between buyers and sellers, that “properly measured, the average actively managed

2015 Capital Market Assumptions

Sellwood Consulting’s 2015 Capital Market Assumptions are now available. These 10-year forward looking assumptions of asset class return, risk, and correlation are the key input variables for our client asset allocation work, including mean-variance optimization, Monte Carlo analysis, and risk budgeting.

Optimal Rebalancing in a Volatile World

Rebalancing is a critically important element of portfolio management, but it gets scarcely the attention it deserves. Our research shows that disciplined rebalancing is necessary to maintain a portfolio at its desired risk and return levels – without it, the whims of the market can considerably alter a portfolio’s composition.

Who’s Afraid of the Big Bad Rates?

With short-term interest rates at historic lows, and the end of the Federal Reserve’s latest bond purchase program scheduled in October, investors are right to wonder about the prospect of rising interest rates. This wonder naturally turns to concern for fixed income portfolios, which derive their return from the overall level of interest rates in the economy and are thus naturally exposed to the effects of interest rate movements, both positive and negative.

Money Market Fund Reform Update

On July 23, 2014, the Securities and Exchange Commission (“SEC”) released an 869-page document adopting amendments to the rules that govern money market mutual funds. The amendments passed by a narrow 3-to-2 margin and, similar to previous amendments adopted in 2010,

Happy Anniversary, Bull Market

It was five years ago yesterday – March 9, 2009 – that the US stock market tumbled to its lowest point in the 2008/09 market crash. The five years that followed have seen a tremendous reinflation of asset values for risky assets.