Second Quarter 2023: Don’t Stop Me Now

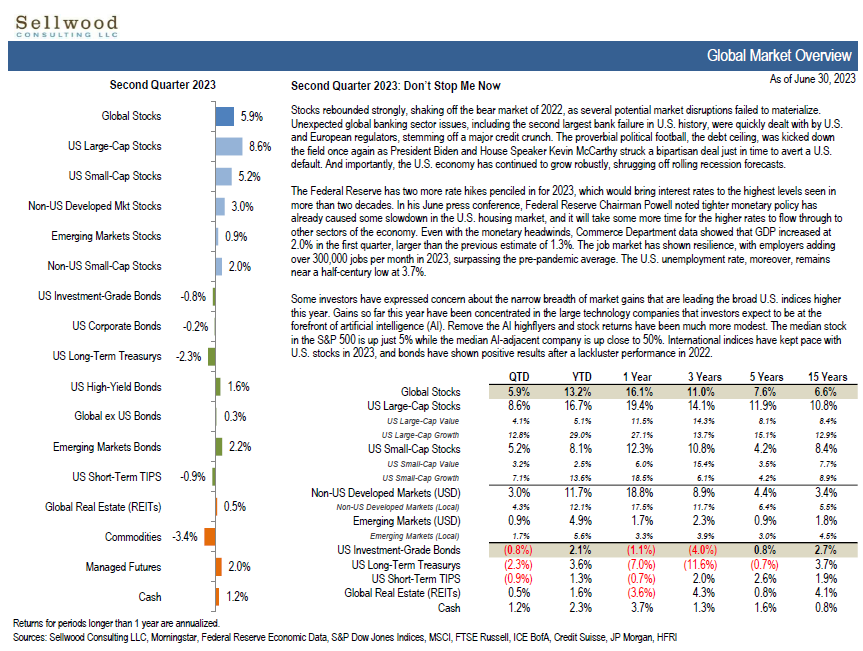

Stocks continued to advance, shaking off the bear market of 2022, as several potential market disruptions failed to materialize. Unexpected global banking sector issues, including the second largest bank failure in U.S. history, were quickly dealt with by U.S. and European regulators, stemming off a major credit crunch. The proverbial political football, the debt ceiling, was kicked down the field once again as President Biden and House Speaker Kevin McCarthy struck a bipartisan deal just in time to avert a U.S. default. And importantly, the U.S. economy has continued to grow robustly, shrugging off rolling recession forecasts.

The Federal Reserve has two more rate hikes penciled in for 2023, which would bring interest rates to the highest levels seen in more than two decades. In his June press conference, Federal Reserve Chairman Powell noted tighter monetary policy has already caused some slowdown in the U.S. housing market, and it will take some more time for the higher rates to flow through to other sectors of the economy. Even with the monetary headwinds, Commerce Department data showed that GDP increased at 2.0% in the first quarter, larger than the previous estimate of 1.3%. The job market has shown resilience, with employers adding over 300,000 jobs per month in 2023, surpassing the pre-pandemic average. The U.S. unemployment rate, moreover, remains near a half-century low at 3.7%.

Some investors have expressed concern about the narrow breadth of market gains that are leading the broad U.S. indices higher this year. Gains so far this year have been concentrated in the large technology companies that investors expect to be at the forefront of artificial intelligence (AI). Remove the AI highflyers and stock returns have been much more modest. The median stock in the S&P 500 is up just 5% while the median AI-adjacent company is up close to 50%. International indices have kept pace with U.S. stocks in 2023, and bonds have shown positive results after a lackluster performance in 2022.