In the 1960 film, “The Magnificent Seven,” an undersized group of seven gunfighters gallantly fought to liberate a small village from a gang of marauding bandits. As the movie’s advertising poster proclaimed, “they fought like seven hundred.”

Today, a different Magnificent Seven are setting investment box office records, although this time the seven are world-changing technology companies, and they have performed better than five hundred (the S&P 500, that is). This recent phenomenon has left the US equity market historically concentrated, and in our view, vulnerable to risks that may not be apparent to the casual moviegoer.

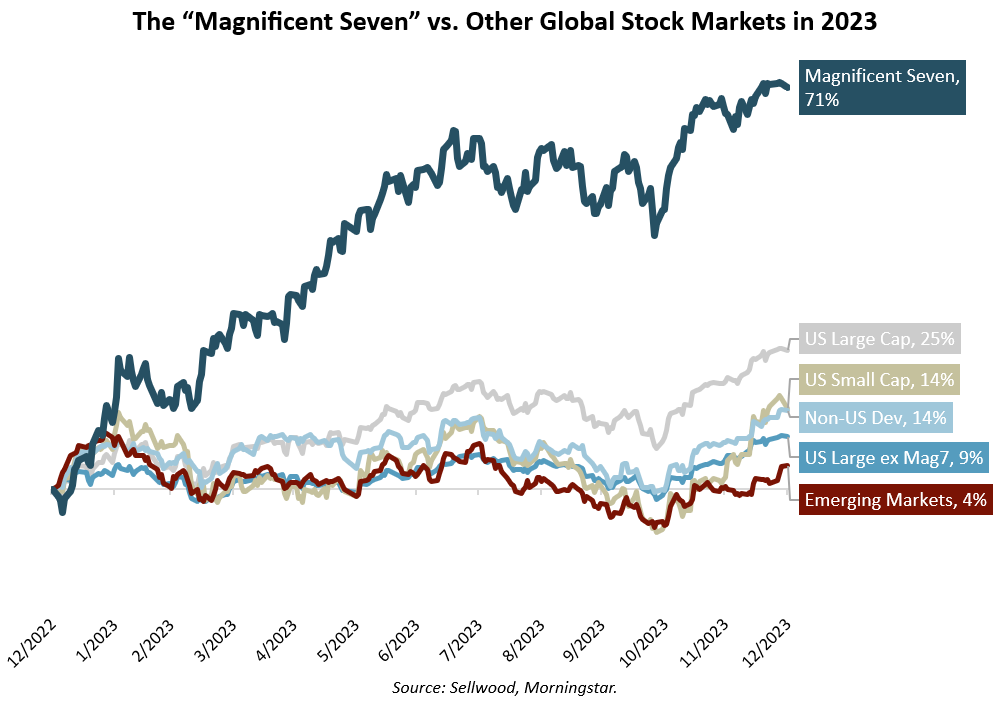

The U.S. stock appreciated considerably in 2023, largely driven by a group of seven major technology companies – Alphabet (Google), Amazon, Apple, Meta (Facebook), Microsoft, Nvidia and Tesla. This handful of companies, currently known as the Magnificent Seven, saw individual stock increases ranging from about 50% (Apple) to 240% (Nvidia) in the year. As a group, they outperformed the rest of the large-capitalization stock market nearly eightfold (71% for an equal-weighted basket of the Magnificent Seven, and 9% for the other “S&P 493,” which excludes them). Their influence was so substantial that nearly two-thirds of the S&P 500’s 26% gain was attributed to just these seven companies. The Nasdaq Composite, which leans heavily towards tech stocks, soared 45%. The tech-leaning Russell 1000 Growth Index experienced its highest year on record, returning 43%.

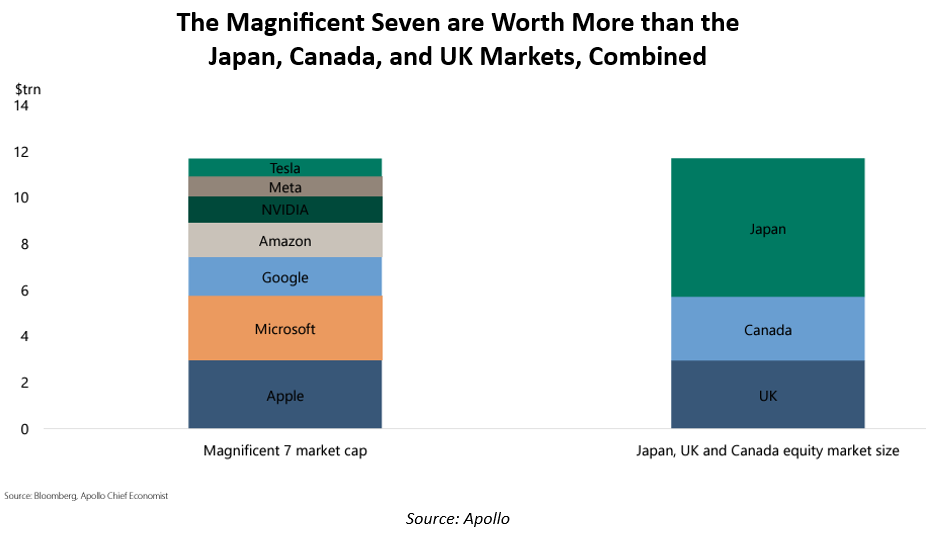

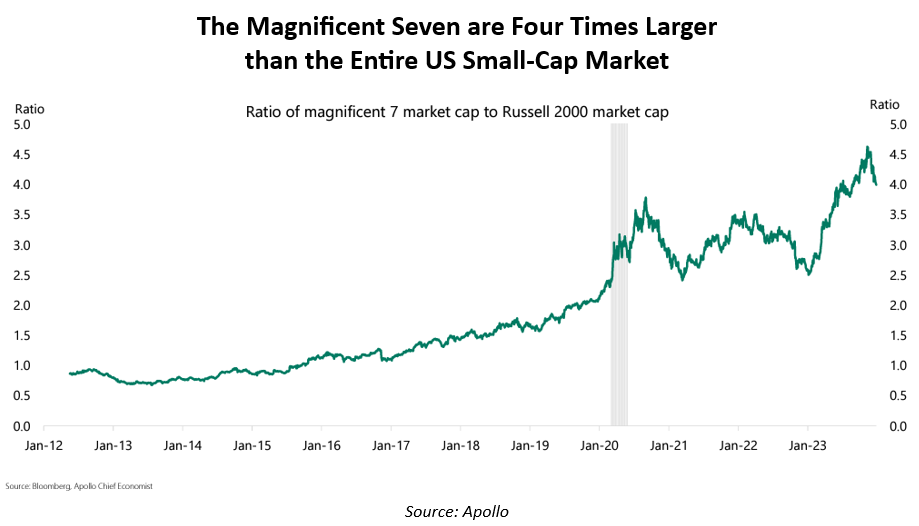

As the market values of these seven companies have risen, so too has their weighting in major indexes. After 2023’s gains, the Magnificent Seven now make up approximately 30% of the total weight of the S&P index. Their combined market value is approximately $11.8 trillion, roughly the size of the Japanese, UK, and Canadian stock markets, combined. Moreover, the combined market value of these seven companies is now four times the size of all 2,000 companies in the Russell 2000 (US Small Cap) Index[1].

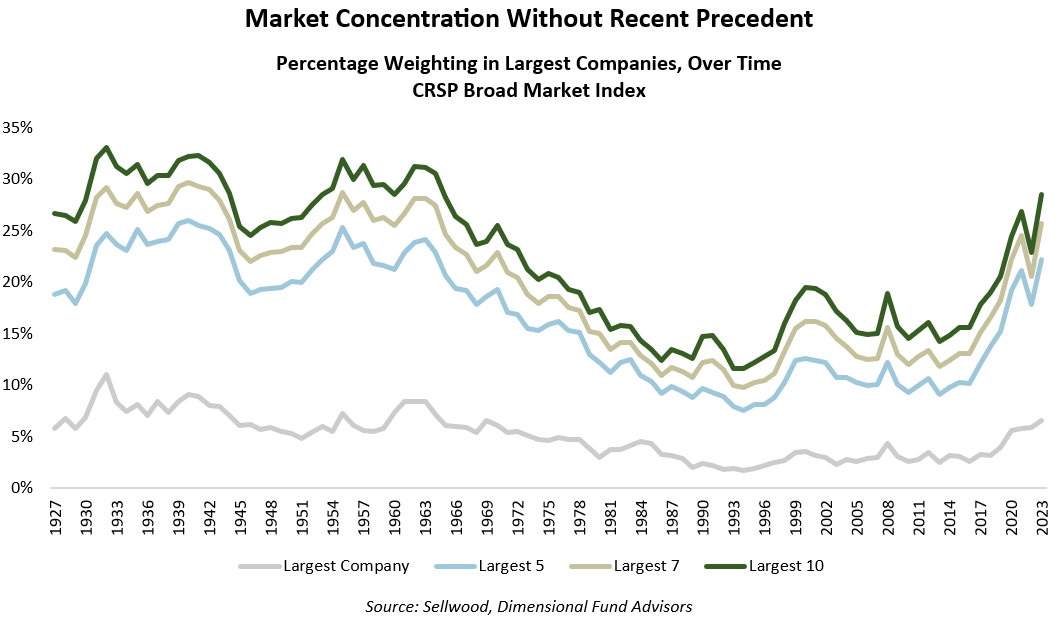

Historically, there have been two distinct periods during which index concentration reached levels that resemble today’s. In the 1960s and 1970s, the “Nifty Fifty,” consisting of 50 blue-chip stocks perceived to be of such high quality that any price was justified, grew to unsustainable valuations and market capitalizations. Earlier, in the 1920s and 1930s, an industrializing economy that rewarded dominant innovators like General Motors, Standard Oil, and Montgomery Ward, followed by a market crash that washed out most smaller companies, created similar levels of concentration. Today, market concentration arises from both the high, monopoly-like profits of the Magnificent Seven, and investor optimism that their competitive positions will be sustained and even grow in an economy that changes at AI speed.

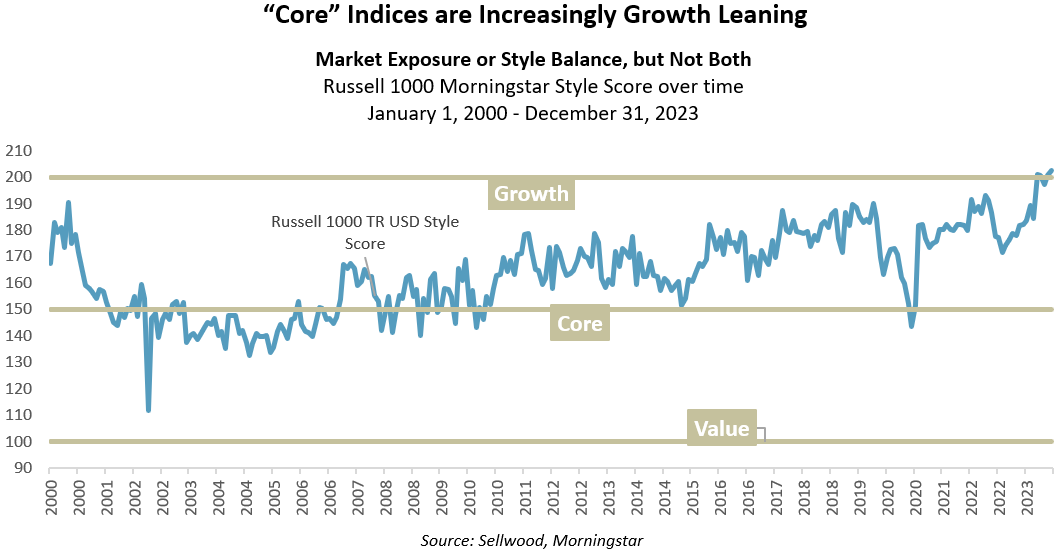

While the dramatic concentration in a smaller handful of companies is a relatively new phenomenon, the increasing influence of “growth” companies in market-representative indexes has been a steady trend following the 2008 Global Financial Crisis. We note that concentration is also influenced by the total number of public companies outstanding, which peaked in the United States in 1996, meaning that there are fewer publicly traded companies both currently and further back in history.

As highlighted in our 2023 Investment Themes paper, the market has shifted toward a more “growth” orientation over the past decade, which carries implications for investors’ allocations. Specifically, investing in a core index, such as the S&P 500 or Russell 1000, no longer delivers a “core” portfolio, balanced between value and growth orientations. We observed in 2023 that investors could have either market exposure or style balance, but not both. Following the Magnificent Seven’s continued outperformance, further concentrating both large-cap core and growth benchmarks in those seven similar companies, this imbalance is even more pronounced today.

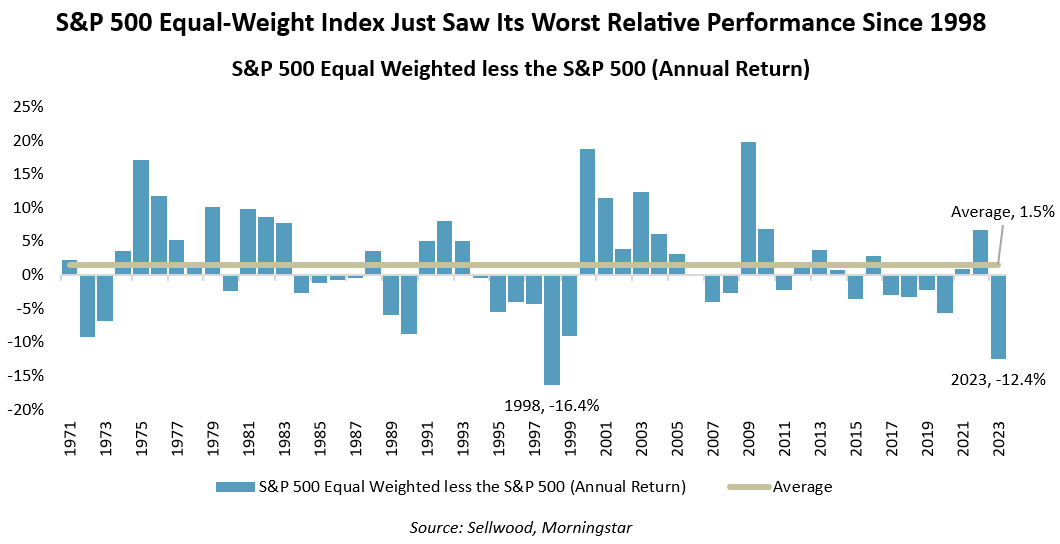

Historically, equal-weighted and value-oriented approaches have tended to outperform periods of peak concentration in the US equity market. Following high levels of market concentration, historically, we have seen the concentration unwind, and market capitalization-weighted indices underperform equal-weighted and value-weighted approaches. As seen in the chart below, 2023 was the worst year since 1998 for an equal-weighted S&P 500, compared to the capitalization-weighted S&P 500. After 1998’s similar experience, an equal-weighted index outperformed a capitalization-weighted index for seven consecutive calendar years, and in similar (opposite) margins.

The Magnificent Seven currently trade at an average of 35 times estimated forward earnings, whereas the broad S&P 500 excluding the Magnificent Seven (the “S&P 493”), trades at just 15.5 times earnings. The reason that investors are willing to pay such a premium for Magnificent Seven companies is higher future earnings expectations for those companies. According to Factset, the Magnificent Seven are expected to grow their combined earnings by 21% next year, three times the expectation for the S&P 493, at 7%. So, while valuations are high, so are expectations for future earnings growth.

Why should concentration concern investors? Concentration increases tail risk in a portfolio. On one hand, after a blistering 2023, the Magnificent Seven revealed that risk is not always the risk of capital loss but can also be the risk of missed opportunities. Passive investors have benefited from the runup in the Magnificent Seven, thanks to their collective outperformance of prior expectations for their earnings. If their earnings growth does not maintain its breakneck speed, however, then their valuations will become stretched. In our view, concentration risk is elevated in pure, market capitalization-weighted U.S. large company stock indexes, which leaves investors more exposed to idiosyncratic movements of a handful stocks, precisely at a time when their optimistic valuations leave little room for error. A more balanced approach to equity portfolio construction would introduce smaller company and value-leaning exposures, which would reduce both concentration and valuation risks in a portfolio. Today’s U.S. large company stock indexes are particularly underexposed to value and small size factors, which may offer a powerful diversification benefit should lofty investor expectations for the Magnificent Seven prove overly optimistic.

The movie did not have an entirely happy ending. Several of the Magnificent Seven died in the battle — but the villagers won.

[1] The Russell 2000 Index tracks the total return performance of the 2000 smallest companies in the Russell 3000 Index.