Third Quarter 2023: Markets on Summer Sabbatical

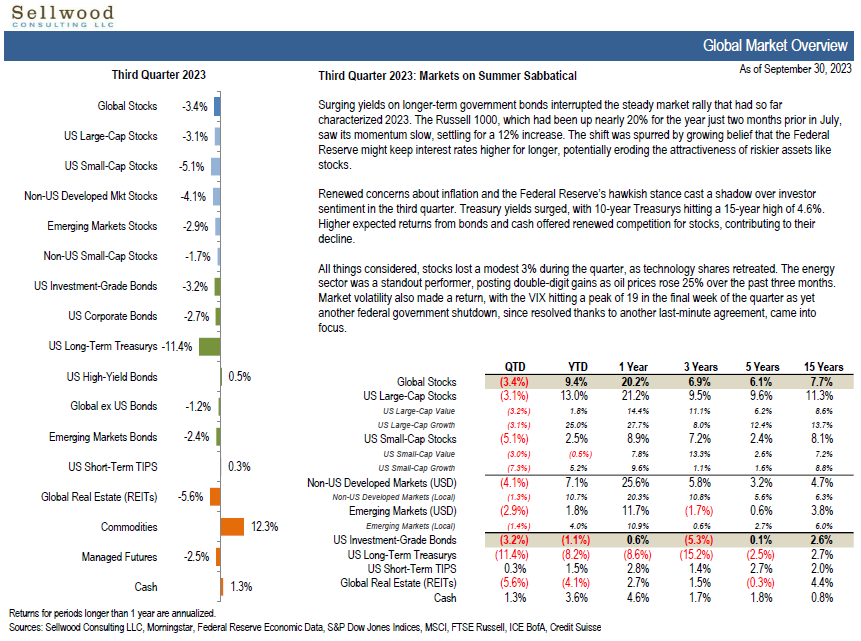

Surging yields on longer-term government bonds interrupted the steady market rally that had so far characterized 2023. The Russell 1000, which had been up nearly 20% for the year just two months prior in July, saw its momentum slow, settling for a 13% increase. The shift was spurred by growing belief that the Federal Reserve might keep interest rates higher for longer, potentially eroding the attractiveness of riskier assets like stocks.

Renewed concerns about inflation and the Federal Reserve’s hawkish stance cast a shadow over investor sentiment in the third quarter. Treasury yields surged, with 10-year Treasurys hitting a 15-year high of 4.6%. Higher expected returns from bonds and cash offered renewed competition for stocks, contributing to their decline.

All things considered, stocks lost a modest 3% during the quarter, as technology shares retreated. The energy sector was a standout performer, posting double-digit gains as oil prices rose 25% over the past three months. Market volatility also made a return, with the VIX hitting a peak of 19 in the final week of the quarter as yet another federal government shutdown, since resolved thanks to another last-minute agreement, came into focus.